Is the increase in private renters a lifestyle choice we should come to accept?

Published: by Kate Wallis

Last week, the Resolution Foundation found that home ownership is at its lowest in 30 years. In fact, home ownership is now comparable with the European countries where we traditionally see renting as the norm.

This drop in home ownership comes as no surprise to us here at Shelter – it’s something that we have been talking about for a long time. Nor will it come as a shock to our new government; Theresa May highlighted in her first statement as prime minister how much harder it has become to buy a home.

A new government provides a real opportunity to turn this around. But do we really need to? Every time someone raises the issue of falling rates of home ownership, there are always people who ask whether falls in ownership are a bad thing or whether they just reflect the fact that more people now want to rent.

You know the: ‘it’s a lifestyle choice’ argument.

Conveniently, the Resolution Foundation research comes hot on the heels of the latest annual report of the English housing survey, and the index of private housing rental prices, which can both help us to answer these questions. Is renting the preferred option for a new generation of more flexible households?

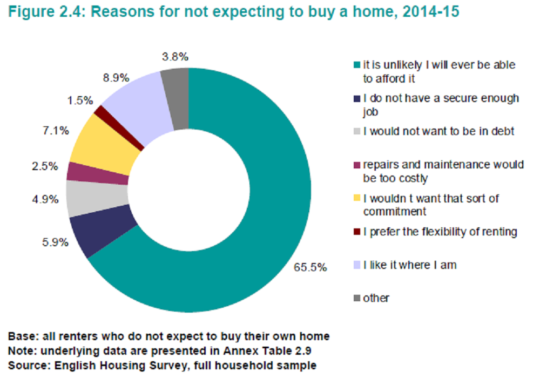

The English housing survey shows that, quite simply: no. People do not prefer renting. Of all private renters who don’t expect to ever step onto the housing ladder, only 1% say it’s because they prefer the flexibility of renting. 9% state that it’s because they like it where they are.

By contrast, the overwhelming reason given for never expecting to buy a home is housing affordability, with 65% listing it as their main hurdle.

Generation rent don’t want to be in the private rented sector forever but they see no alternative because of cost. Even liking things where you are is not necessarily a preference for renting in the long-term. This could mean that a family prefers the community or location they are currently living in, but do not expect to be able to buy a house there.

Of course, this opens up another bigger question, which is why private renting is so unpopular in England, when in other countries it’s seen as the norm.

Part of the reason stems from affordability and stability. It is no secret that the cost of private renting is increasing. Prices already cost more than 30% of the median take home salary in almost half of England. Rental prices have increased 2.5% on average across England since this time last year, a trend set to continue. Furthermore, in England the prevalence of, 6-12 month Assured Shorthold tenancies give renters very little security and allows unpredictable rent increases annually.

The increase in people living in the private rental sector has also seen a shift in the types living there. Given the insecurity and cost of being a private tenant, it’s difficult to imagine how the 27% of private renters who are families with dependent children could possibly prefer their current situation. Especially considering the detrimental educational impact for the 65,000 families in the private sector who had to change their children’s school during their last move.

The negatives of our model of private renting are clear and have been addressed by countries across Europe. Longer, more secure tenancies and a clearer plan for rental increases would begin to solve generation rent’s immediate problem.

A clear and comprehensive approach from our new government will then pave the way to fixing home ownership and allow renters to fulfil their dream of owning the roof over their head. We need more genuinely affordable homes of all tenures to help those trapped in private renting, including an expansion of alternative models like shared ownership and building social homes for those who need them.