Shocking new analysis shows the severe lack of private rentals in England that are affordable for low-income renters receiving housing benefit.

1.8 million private renters in England – one in three of all renters – receive help through universal credit or legacy housing benefit to afford their home. The local housing allowance (LHA) sets the maximum amount they can claim, and is meant to ensure that people can access the cheapest 30% of local homes. But LHA has been frozen since 2020, based on rents in 2018-19, while private rents have risen rapidly to their highest recorded levels.

New analysis from Chartered Institute of Housing and Shelter reveals that the freeze has left a vanishingly small number of private rentals that are actually covered by LHA rates – and therefore affordable for the 1.8 million renters and their families who rely on housing benefit to avoid arrears and homelessness.

Last year, fewer than one in five private rents in England were within LHA rates. But with one in three renters only able to afford less than one in five homes, the system is broken while the government ignores the growing scandal of homeless families in temporary accommodation and offers inadequate sticking plaster solutions.

A national affordability crisis

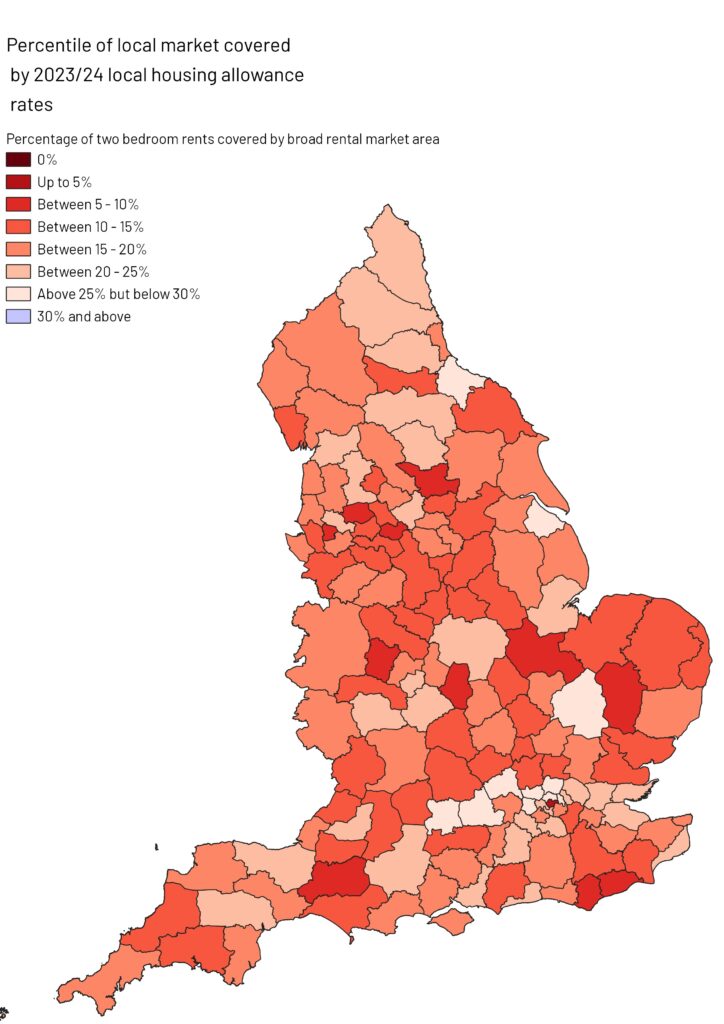

Some local areas are worse affected than others – but the headline is that households everywhere in England are struggling with the impact of the LHA freeze.

Map of the percentage of two-bedroom rents affordable within the local housing allowance rates by broad rental market area in England. Data source: Valuation Office Agency, Local Housing Allowance List of Rents: 2021-22. Percentile analysis by Chartered Institute of Housing and mapping by Shelter.

As the map above shows, in every local area LHA fails to cover the cost of the cheapest 30% of two-bedroom family homes. In some parts of the South West, one in 10 or fewer two bedroom rents are affordable, at just 10% in Bristol and Mendip and as low as 7% in Yeovil. The worst affected part of the South East is the Sussex coast, where less than 10% are affordable within LHA rates in the Eastbourne and East Sussex areas.

But this is not an issue confined to the south where rents have long been unaffordable: since the start of the pandemic, other regions of England have experienced staggering increases in private rents. In both Leeds and the Greater Manchester area, there are now low numbers of affordable two-bedroom rents: just 9% in Leeds, 10% in Bolton and 5% in Tameside. And low affordability affects the countryside too: just 8% in parts of rural Suffolk (around Bury St Edmunds) and 13% in North Yorkshire (around Scarborough).

Some households face even more of a challenge finding an affordable home, such as people under 35 without children, who are normally only eligible to claim the cost of a room in a flatshare. It has become very common for there to be virtually no affordable rents at this shared accommodation rate in parts of the country. In 24 out of 152 local areas in England, 5% or less of rooms to rent were affordable. And in coastal areas like North Cornwall, North Devon, Plymouth and Dover there were no affordable rents recorded within the shared accommodation rate at all.

Renters left with £151 a month shortfalls

These findings are based on data collected by the Valuation Office Agency on the rents paid by actual tenants from October 2021-September 2022. It is important to remember that this means they don’t reflect increases in rents since then – which other government data shows has continued to accelerate. This data also doesn’t reflect the market for new lets – which analysis from last year showed was even harsher, with as few as one in 50 newly advertised private lets being affordable for people claiming housing benefits in June 2022.

What this analysis does tell us is that private renters on low incomes are being squeezed out by rocketing rents. The government’s freeze on LHA means that 1.8 million private renters and their families are left fighting to stay in a shrinking pool of affordable homes.

And if they can’t find one, which is the case for almost 900,000 households, they face shortfalls to their rent of an average £151 a month which they must make up from other limited income at a time when the cost of other essentials keeps going up.

These huge shortfalls leave private renters at high risk of going into rent arrears and pushes families towards homelessness. With fewer and fewer affordable private rentals for people on housing benefit and a severe shortage of social housing, we are sadly left with a homelessness crisis: there are now more than 101,000 homeless households living in temporary accommodation, the highest number for almost 20 years.

The evidence is clear: the government must end the damaging freeze to local housing allowance which is leaving low-income families with nowhere they can afford to call home.

If you’re struggling to find somewhere to rent or facing homelessness because housing benefit isn’t enough to afford local homes, you can help us to demand the government ends the LHA freeze by sharing your story.